Indian Stock Market: Domestic equity benchmark indices, Sensex and Nifty 50 are expected to open slow and remain volatile on Tuesday amid caution on weak global market cues.

Asian markets traded lower, while US equities closed mixed overnight on rising Treasury yields.

According to CME FedWatch, markets are pricing in an 89% probability that the U.S. Federal Reserve will cut rates by 25 basis points (bps) next month, compared with a 50% probability a month ago, when investors expected a larger cut of 50 bps. Had seen equal possibility of. Showed the equipment.

Traders are expecting an overall easing of 41 bps for the rest of the year, with the Fed kicking off its rate-cutting cycle with a 50 bps cut in September, Reuters reports.

Indian stock market indices closed with a decline amid profit-booking at higher levels on Tuesday.

Sensex It fell 73.48 points or 0.09% to 81,151.27, while the Nifty 50 fell 72.95 points or 0.29% to 24,781.10.

“The markets started the week on a slow note due to weak results from index giants like Kotak Mahindra Bank, Tata Consumer Products and UltraTech Cement, which dragged the indices lower. On the positive side, HDFC Bank reported stable numbers limiting the downside. Overall, we expect the market to remain under pressure due to continued selling by FIIs and decline in household income,” said Siddharth Khemka, head of research, wealth management, Motilal Oswal Financial Services Ltd.

Here are the key global market cues for Sensex today:

Asian market

Asian markets were lower on Tuesday after a mixed session on Wall Street overnight.

Japan’s Nikkei 225 fell 1.34%, while the Topix fell 1.04%. South Korea’s Kospi fell 1.21% and Kosdaq fell 2.11%.

The blue-chip CSI300 index slipped 0.3%, while the Shanghai Composite index fell 0.1%. The Hong Kong benchmark Hang Seng was down 0.2%.

Give a nifty gift today

GIFT Nifty was trading around 24,800 levels, a premium of about 10 points from the previous close of Nifty futures, indicating a flat opening for Indian stock market indices.

wall Street

US stock markets ended mixed on Monday as Treasury yields rose.

The Dow Jones Industrial Average fell 344.31 points, or 0.80%, to 42,931.60, while the S&P 500 fell 10.69 points, or 0.18%, to 5,853.98. The Nasdaq Composite added 50.45 points, or 0.27%, to 18,540.01.

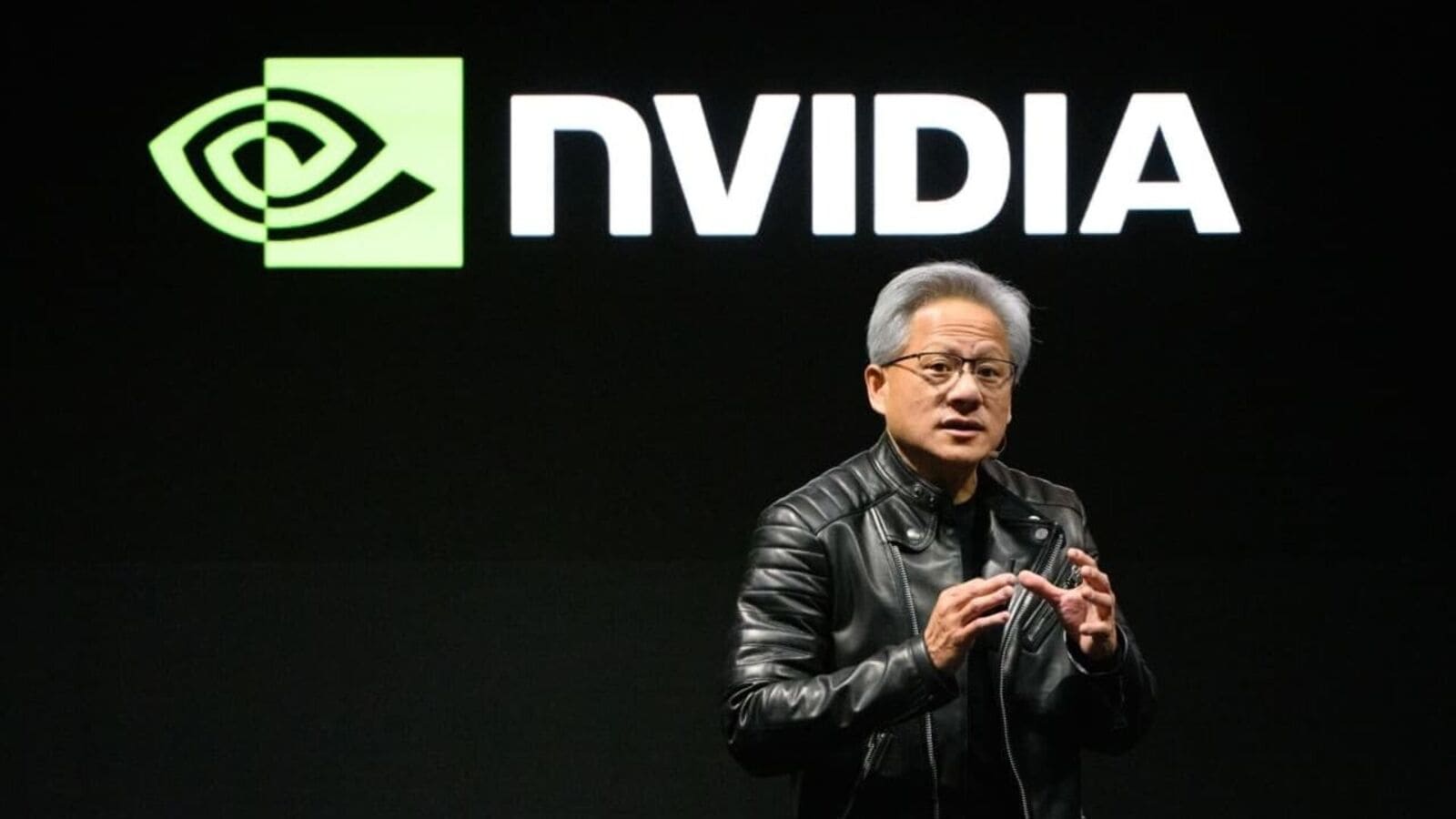

Nvidia’s stock price jumped 4.14% to close at a record high of $143.71. Tesla’s share price fell 0.84%, while Boeing’s shares rose 3.1% and Spirit Airlines’ shares rose 53.06%.

US treasury yields

US benchmark 10-year Treasury yields hit a 12-week high on Monday as bonds fell on expectations of a US Federal Reserve rate cut. The 10-year Treasury yield reached a 12-week high of 4.17%. High.

US Federal Reserve

Four Federal Reserve policymakers expressed support for further interest rate cuts, but appeared to differ on how fast or how far the cuts should be made, Reuters reported. Three of them preferred to go slower, using words like “modest” and “gradual” to describe their thoughts on the right pace for rate reductions. Fourth, San Francisco Fed Chair Mary Daly said she thinks Fed policy is “too tight” and that she does not believe a strong economy, as long as inflation continues to decline, will prompt the central bank to lower rates. Should be stopped from doing.

rbi bulletin

The cumulative rate hike of 2.5 percentage points by the central bank from May 2022 has negatively impacted headline inflation by 1.60%, the RBI bulletin said. “The policy rate hike moderated inflation expectations and moderated aggregate demand, generating a disinflationary response,” it said.

oil prices

Crude oil prices fell after rising nearly 2% in the previous session. Brent crude futures for December delivery fell 0.3% to $74.03 a barrel, while US West Texas Intermediate crude futures for November delivery fell 0.41% to $70.27 a barrel.

dollar

The US dollar hit a two-and-a-half-month high on Tuesday as Treasury yields rose. The dollar index, which measures the U.S. currency against six rivals, was last at 103.96, rising to 104.02 on Monday, its highest since Aug. 1. The index is poised to gain more than 3% on the month.

(With inputs from Reuters)

Disclaimer: The views and recommendations given above are those of individual analysts or broking companies and not of Mint. We recommend investors to check with certified experts before taking any investment decision.

catch ’em all business News , market news , today’s latest news events and latest news Updates on Live Mint. download mint news app To get daily market updates.

MoreLess